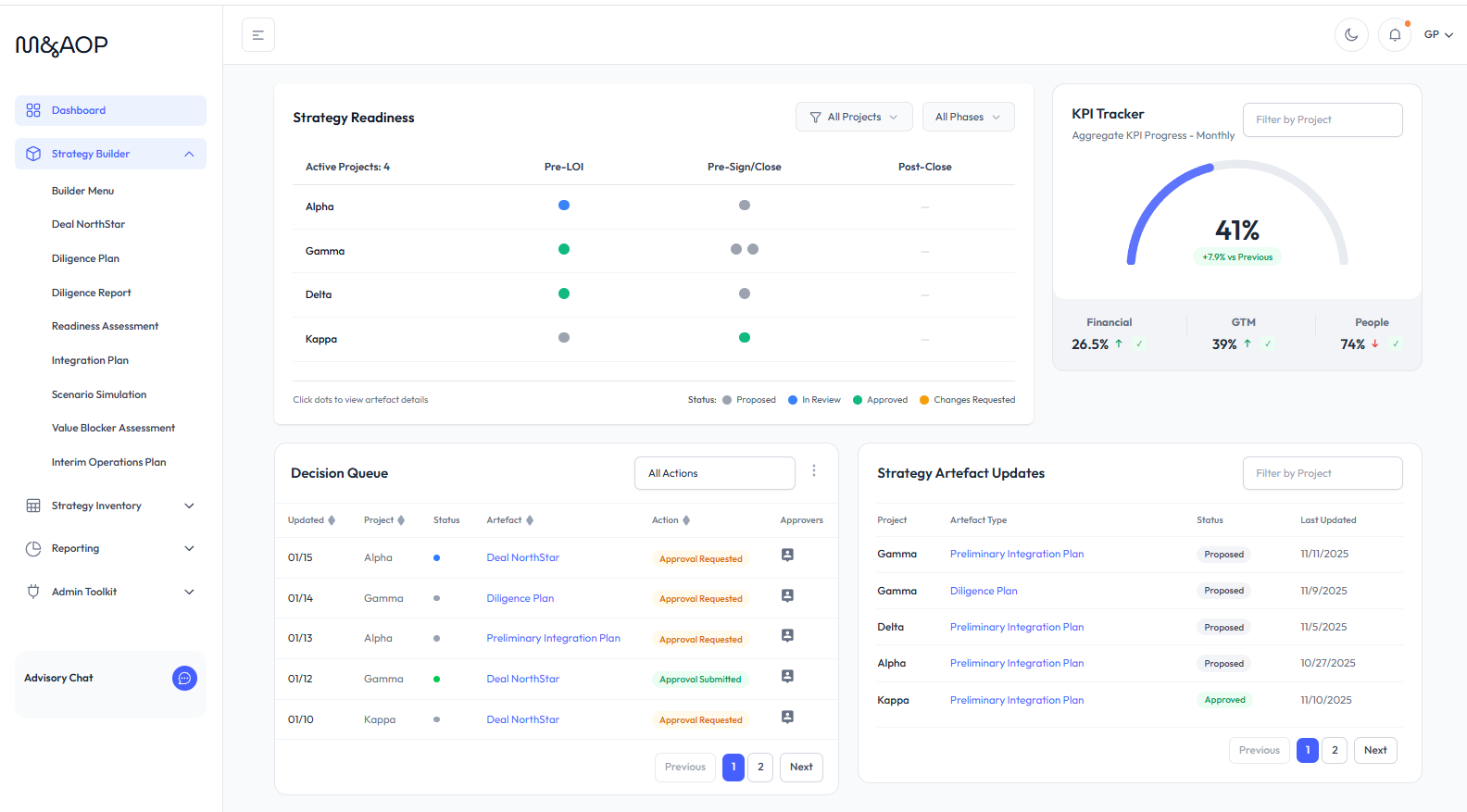

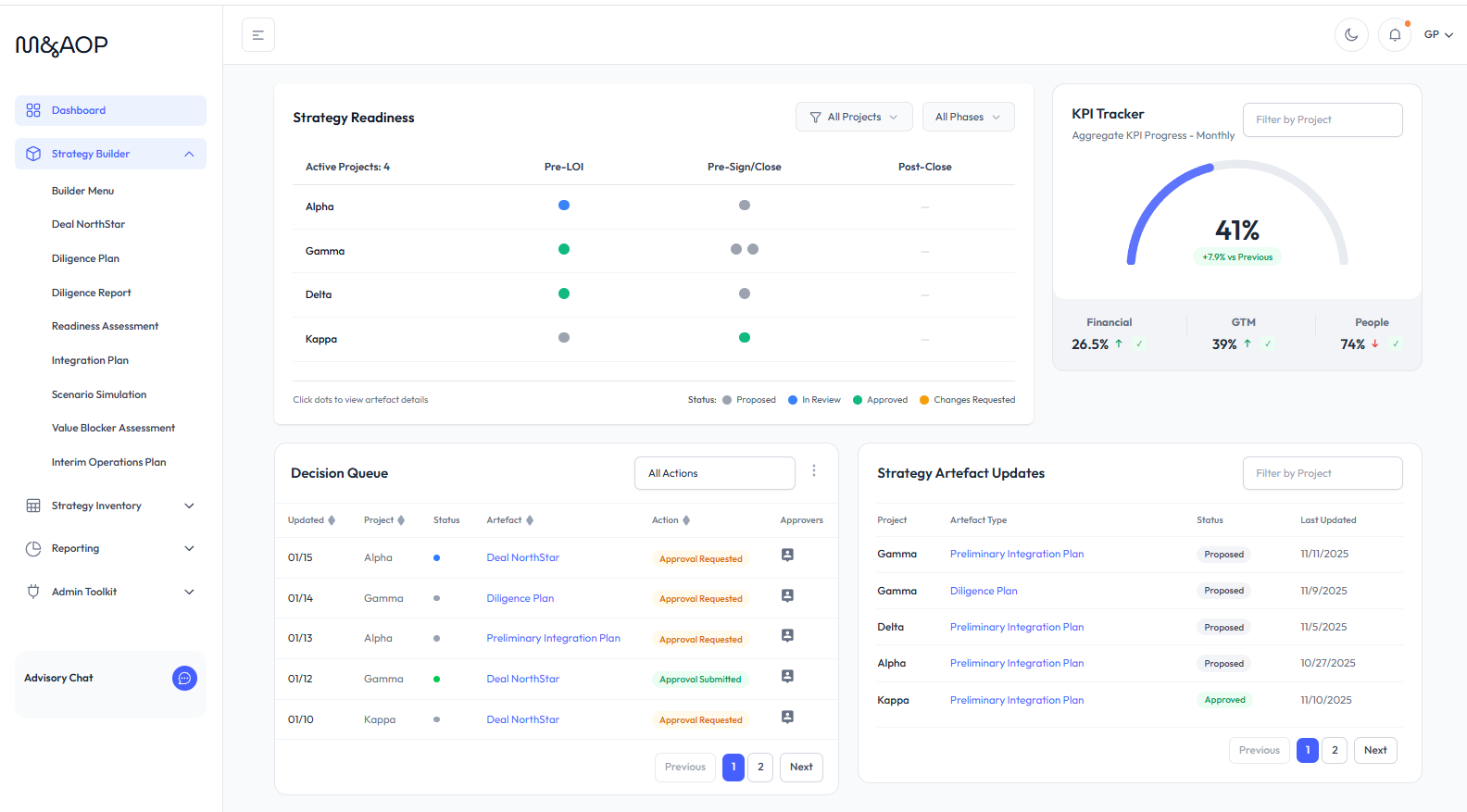

Enterprise AI platform designed to guide and automate strategic decisioning across deal phases, and anchor execution to deal rationale.

Leveraging decades of experience leading Fortune 100 transactions — we guide deal strategy, value creation, and M&A capability-building.

Combined advisory + platform for targeted solutions, customized enablement and implementation, and accelerated impact.

Deal NorthStar Workshop

Due Diligence Strategy

Integration Readiness Assessment

Inorganic Roadmap Definition

Preliminary Integration Strategy

DMO and IMO Governance Setup

Change Management Plan and Decisioning Matrix

Integration Plan Buildout

Interim Operations Strategy

End-State Blueprinting

Stakeholder Communications & Reporting Strategy

M&A Value Blocker Assessment

Integration "Road Ahead" Session

M&A-to-Standard Planning

M&A Lifecycle Bootcamp

Deal Sponsor Bootcamp

M&A Function Training

M&A Framework Baseline

M&A Operating Model

Readiness Benchmarking

Prefer a targeted solution for critical deal milestones, flexible on-demand advisory, or custom enablement?

Download Solution Overview

Establish programmatic M&A capabilities with existing teams.

Shift from deal-by-deal execution to an MVP playbook that drives ROI more predictably.

Boost team enablement at all levels, with agentic advisory and governance.

Up-level existing framework to optimize matrixed operating model and strategic roadmap.

Boost repeatable value-capture, execution speed, stakeholder alignment; mitigate recurring risk-to-value execution blockers.

Systematize value creation across portfolio companies — building lean scalable capabilities without adding dedicated M&A headcount.

Transform time-to-value, exit readiness, and multiples with agentic advisory and decisioning.

Historically, over 70% of deals fail to capture intended value. Today’s landscape is even more complex: a $3.4 trillion deal wave is unfolding amid global factors of AI infrastructure buildout, geopolitical fragmentation, and supply chain restructuring. Yet in the past 5 years most M&A teams were cut up to 75%, eroding critical M&A capacity and expertise.

Compounded integration risk, delayed synergies, and blocked deal ROI -- how to succeed in this landscape?

Full Article

.

M&AOP is the first AI platform purpose-built for M&A strategic decisioning—engineered to anchor strategy to execution, and orchestrate decisions around value drivers. It doesn’t replace your existing process or tools—it makes them more strategic, with agentic automations and advisory across deal phases and workstreams.

This isn’t another project management app, generic framework, or set of cookie-cutter templates!

Download DataSheet

Most M&A failures aren't about overpaying - they're strategic translation and alignment misses. When boardroom vision doesn’t provide clarity across the deal lifecycle, through execution and stakeholder transitions, deals drift into the "acquisition graveyard” with stalled synergies and compounded integration debt. The North Star approach provides the missing mechanism for programmatic M&A strategy that drives alignment and ROI.

Tiger Team was founded by Fortune 100 M&A veterans to enable companies of all sizes to optimize deal execution and value creation through M&A excellence. Our solutions combine the innovative M&AOP platform, strategic decisioning framework,and advisory services. We support the full M&A lifecyle, engaging with corporates transitioning to or optimizing programmatic M&A, and private equity firms pursuing portfolio-wide governance.