M&AOP: AI-Powered Strategic Orchestration for M&A

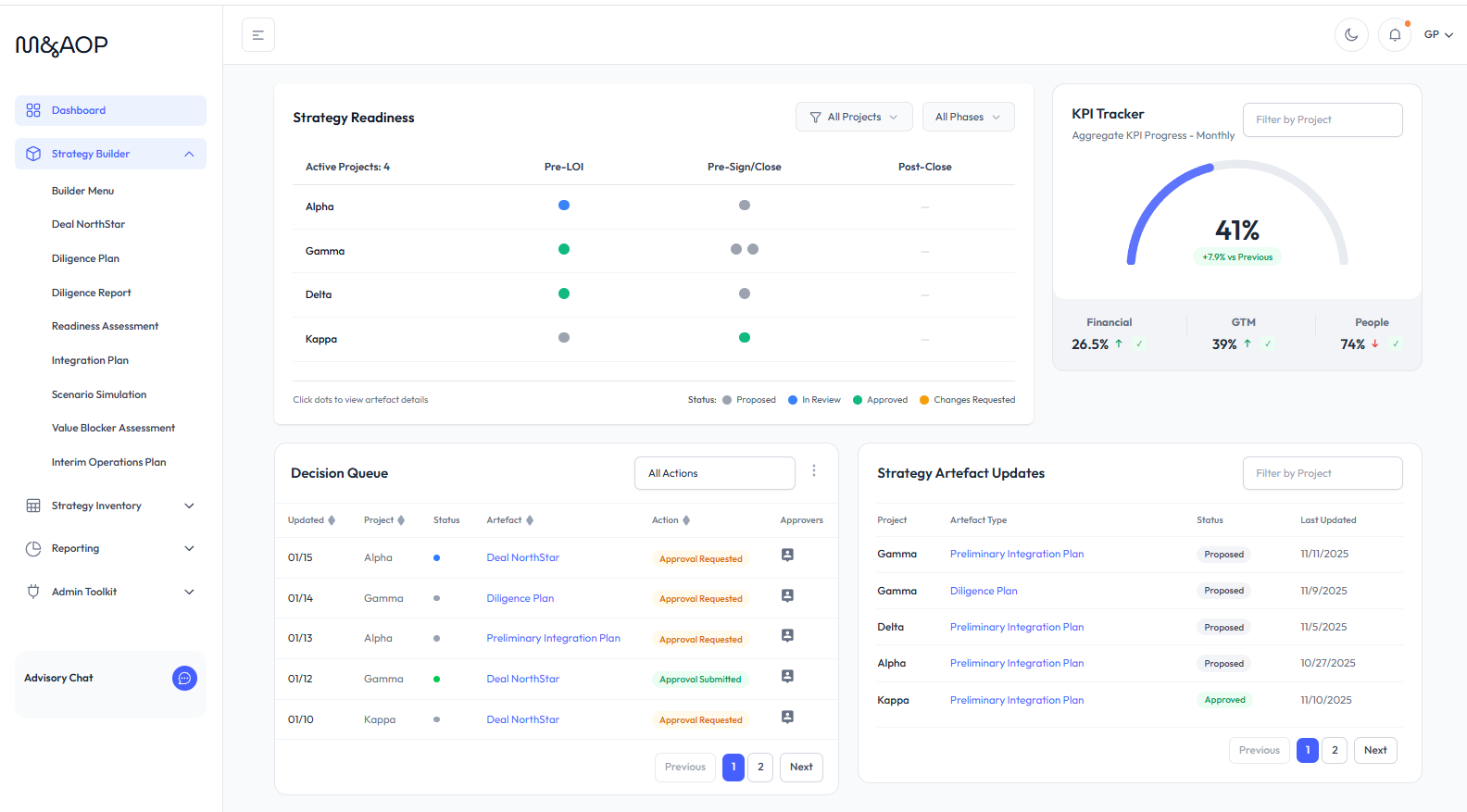

Portfolio Dashboard

Real-time view of strategy readiness, deal KPIs, and artefact status across all deal portfolio.Strategy Builder

Build repeatable Deal NorthStars. Generate diligence checklists, findings reports, and integration plans based on your NorthStar.Reporting & Metrics

Automated KPI tracking, deal performance reporting; and agentic strategic-fit insights across the deal lifecycle.Artefact Inventory

Centralized catalog of decisions, plans, and artefacts with version history, approval workflows, and import/export support.Governance

Role-based access controls, framework configuration, and audit trail reporting.

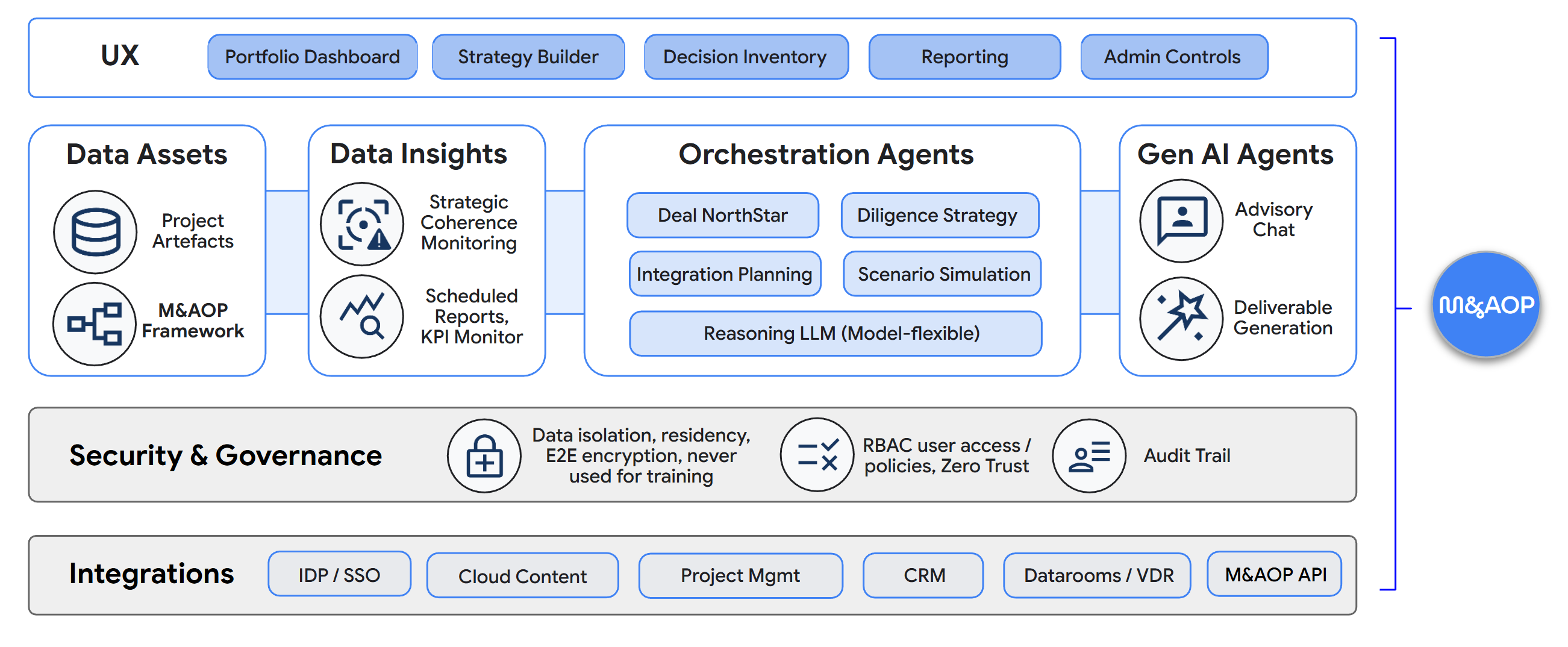

Advisory Chat

Chat-based guidance leveraging our decisioning framework and industry best practices. Get expert deal strategy and framework help, and built-in product help.Deliverable Generation

Auto-generate integration plans, diligence checklists, interim ops policies, and other artefacts — calibrated to deal rationale and acquired company profile.Strategic Validation & Monitoring

Autonomous agents continuously scan for misalignments across workstreams, flagging risks and decisioning gaps before they become value blockers.Scenario Simulation

Compare integration strategies before committing resources; stress-test assumptions and project deal outcomes.M&AOP Feature Spotlights

- Deal NorthStars: Programmatic Strategic Rationale

- Agentic Strategy Monitoring (Coming Soon)

- Agentic Diligence Planning (Coming Soon)

- Agentic Integration Planning

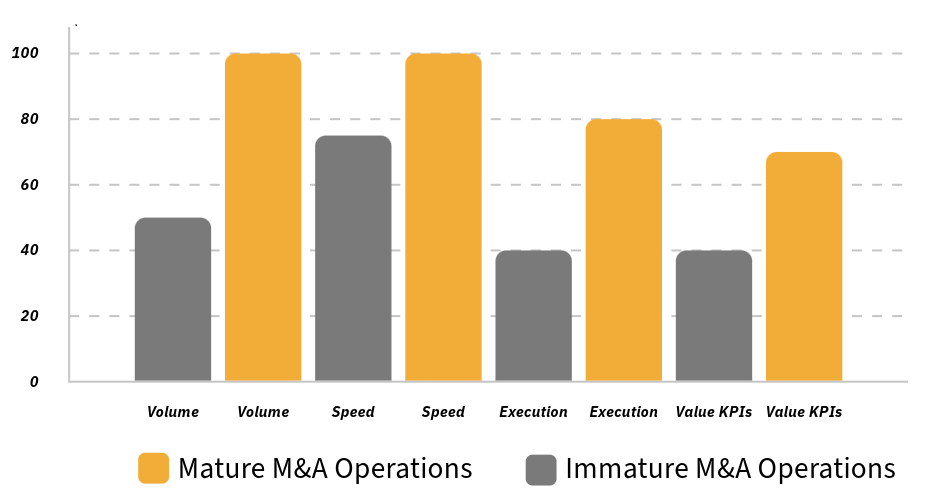

M&AOP is designed for corporate M&A teams, private equity firms, and mid-market organizations of all sizes. Whether you are a serial acquirer managing a portfolio of concurrent deals or a lean team executing your first acquisition, M&AOP adapts to your scale, team structure, and deal complexity.

M&AOP is not a project management tool. It is a strategic orchestration platform purpose-built for M&A. While project management tools track tasks and timelines, M&AOP anchors every workstream to deal rationale, automates strategic deliverables, and surfaces alignment gaps across your deal portfolio. It works alongside your existing tools rather than replacing them.

A Deal NorthStar is a structured strategic rationale for a deal — capturing value drivers, synergy targets, risk factors, and integration priorities in a format that can be referenced and validated throughout the deal lifecycle. M&AOP uses the NorthStar to anchor all generated deliverables, agentic recommendations, and performance reporting to the original deal thesis.

M&AOP is built on a zero-trust architecture with end-to-end encryption, data isolation per organization, and role-based access controls. Your deal data is never used to train AI models. The platform supports enterprise identity providers (IDP/SSO) and maintains a full audit trail for governance and compliance purposes.

Most teams are up and running within days. M&AOP includes built-in onboarding, embedded M&A best practices, and an adaptive framework that configures to your deal context automatically. For enterprise deployments with custom integrations or framework configuration, our Customer Success team supports a structured onboarding and pilot program.

M&AOP connects with the tools already in your M&A stack, including CRMs, project management platforms, virtual data rooms, cloud content systems, and document management tools. For enterprise customers, the M&AOP API enables custom integrations with existing deal workflows and reporting systems.